ACRE acquires distressed loans (NPL) from financial institutions and turns them around to maximise and realise their latent value. An open architecture, strong deal sourcing, underwriting and execution capabilities along with high client servicing standards have enabled the company to become one of the largest ARCs in India, as well as the preferred ARC for multiple investors.

As a sector-agnostic investment platform for NPLs, we have identified several key market opportunities with the best potential for high returns for all involved stakeholders.

ACRE acquires consumer loan accounts, typically accounts with receivables of up to INR 10 crores. For these portfolio acquisitions, we follow a data-driven underwriting approach, and combine it with our vast local knowledge to ensure speedy resolution of these assets.

Student loans

Retail mortgages

Commercial mortgages

Vehicle loans

Business loans

Personal loans

Credit cards

Security credit

Over the past few years, we have increased our focus on working capital or terms loans (including loans taken for industrial and trading purposes), typically with aggregate receivables of up to INR 100 crores. These loans are backed either partially or fully by collaterals.

For SME loans, we follow a detailed underwriting approach that includes:

These loans typically have aggregate receivables in excess of INR 100 crores. Since such NPLs often include complex situations and multiple lenders, our underwriting philosophy is highly detail-oriented and solutions-focused. We focus on capturing business value during work out of these loans.

For every corporate NPL, ACRE undertakes an extensive assessment of:

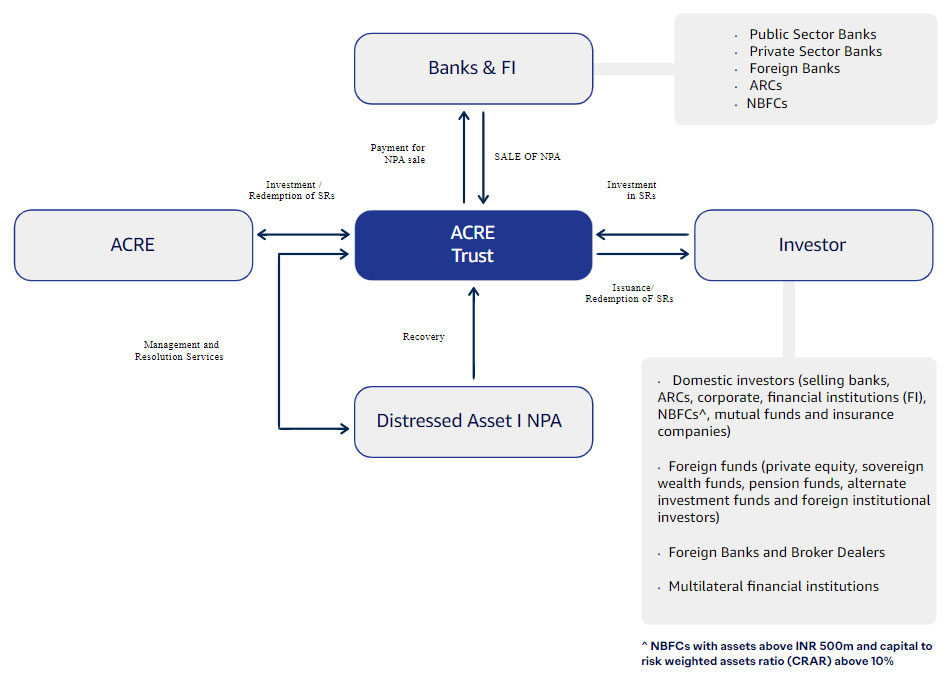

A majority of ACRE’s NPA acquisitions happen via a trust structure.

The ACRE Trust acts as the key liaison between the holders of NPAs, such as banks and other financial institutions, and potential investors in those NPAs. ACRE functions as the sole trustee of all acquired assets and is responsible for asset acquisition, recovery and resolution.

ACRE invests in NPLs either as a sole investor or by working with investors who subscribe to the Security Receipts (SRs) issued by ACRE Trust.

Origination

. Active coverage by ACRE of all sources

. Sources include:

- Banks (auctions/ lead by ACRE)

- Advisors/Consultants

- Potential Investors

Due Diligence

. Driven by deal size, expected resolution strategy and nature of deal

. DD at bank supplemented by outside DD and where applicable, by corporate DD.

Internal Approvals & Bid

. Internal approval required prior to any binding bid

. Biding offer to bank & negotiations

Execution & Funding

. NPLs acquired in Trusts (typically pre-formed for efficiency)

. Funding from ACRE and external investors to trusts and then to bank

. Intense process since settlement timelines are T+0 before binding bid

Post Closure Activities

. Pre-identified post closure compliances including intimation letters to borrowers, document collection, document registration

Asset Management

. Resolution strategy for the account is decided and implemented

. Regular asset management and account monitoring carried out by deal team

. Investments are regularly reviewed internally as well as by external credit rating agencies

2024 Copyright©Assets Care & Reconstruction Enterprise Limited. All rights reserved.